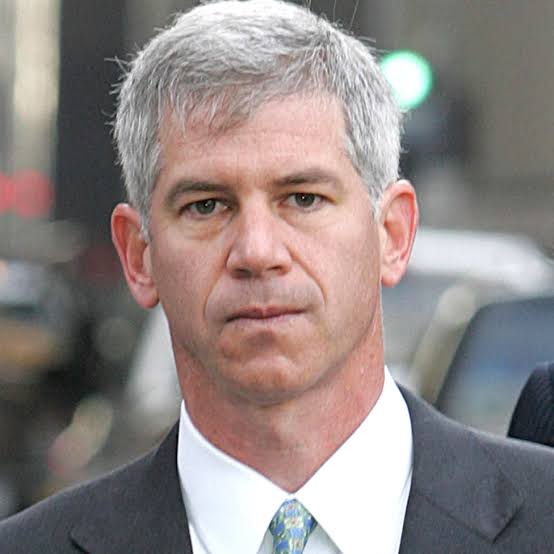

Andrew Fastow is best known as the former Chief Financial Officer (CFO) of Enron Corporation, a role that placed him at the center of one of the largest corporate fraud scandals in American history. .

Hired in 1990, he became a key architect of the complex financial structure that allowed Enron to hide debt and inflate profits. His actions contributed significantly to the company’s rapid growth and catastrophic collapse, which led to bankruptcy in 2001.

Prevalent!!:

File

- Full name: Andrew S. Fastow

- Date of birth: December 22, 1961

- Age: 64 years old

- Gender: Male

- Place of birth: Washington, DC, USA

- Nationality: American

- Occupation: Sales employee

- Height: 1.85 m

- Parents: Carl Fastow and Joan Fastow

- Siblings: Two

- Spouse: Lea Fastow (married 1991–present)

- Children: Jeffrey Fastow and Mathew Fastow

- Relationship status: Married

- Religion: Not applicable

- Ethnicity: White

- Net worth: $2.5 million

Early life and education

Andrew Fastow is currently 64 years old, born on December 22, 1961 in Washington, DC. He has parents: Carl and Joan Fastow, and younger siblings. Fastow attended Tufts University, where he earned a Bachelor’s degree in Economics in 1983.

He then earned an MBA from the University of Chicago Booth School of Business in 1989. His educational background equipped him with the skills necessary for a career in finance and business management.

Personal life

Fastow married Lea Fastow in 1991 and they have two children together, Jeffrey and Mathew. Throughout his legal troubles and jail time, Lea still supported him.

Their relationship was characterized by resilience as they overcame the challenges posed by the Enron scandal.

Career

Fastow’s career took off when he joined Enron in 1990, eventually rising to the position of CFO in 1998. He was instrumental in creating off-balance sheet units and complex financial instruments to cover hid Enron’s true financial condition from investors and regulators. These practices allowed the company to report inflated profits while hiding significant debt.

In October 2002, Fastow was indicted on multiple counts of fraud and conspiracy. He negotiated a plea deal that resulted in a 10-year prison sentence and the forfeiture of more than $29 million in assets in exchange for cooperating with federal investigations into Enron’s activities.

Net worth

Andrew Fastow’s net worth is estimated at $2.5 million, primarily coming from his previous income as a CFO and speaking engagements after his release from prison.

Argumentative

Andrew Fastow’s involvement in the Enron scandal made him a central figure in discussions of fraud and corporate ethics. His role as CFO required him to oversee financial reporting practices that ultimately misled investors about Enron’s financial health.

Fastow played a key role in developing complex financial structures designed to hide debt and boost earnings through various schemes involving special purpose entities (SPEs).

The consequences of these actions began to become publicly known when Enron declared bankruptcy on December 2, 2001, resulting in significant financial losses for shareholders and employees alike. The scandal prompted investigations by federal authorities, culminating in indictments against several top executives.

In October 2002, Fastow faced multiple charges including securities fraud, wire fraud, and conspiracy. He initially faced up to 78 charges but negotiated a plea deal that significantly reduced his potential sentence in exchange for his cooperation with prosecutors investigating the directors. Other executives were implicated in the scandal.

Fastow eventually pleaded guilty to two counts of conspiracy on January 14, 2004, admitting that he engaged in fraudulent activities intended to enrich himself at the expense of Enron shareholders. He was sentenced to six years in prison but only served about four years before being released to a halfway house.

After his release, Fastow began speaking publicly about ethics in business practices, emphasizing the importance of recognizing ethical dilemmas in corporate environments. His reflections on his past actions highlight a broader conversation about accountability and integrity within corporate leadership.

Social Media

- Instagram: Not applicable

- Twitter: Not applicable