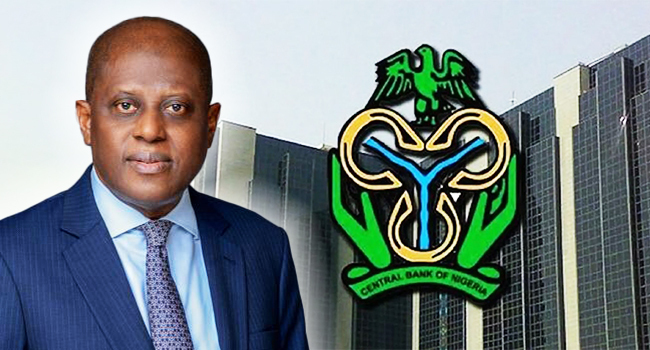

The Central Bank of Nigeria (CBN), under the leadership of Olayemi Cardoso, recently issued a circular that shocked the Bureau De Change (BDC) community nationwide.

The directive requires all BDC operators to reapply for their operating licences, introducing a series of changes that many believe are designed to exploit these financial services providers.

Real BDC operator

To clarify, the BDC operators affected by this directive are different from the money changers on the streets in bustling cities like Lagos and Abuja, who loudly call for currency exchange. Instead, this refers to their top bosses—figures like Alhaji, Mr. Emeka or Femi—who run these operations from the office and are regularly involved in negotiations and rate confirmations over the phone.

BDC operators are classified into two tiers. Type (Tier) 1 operators are larger and more capable, like commercial banks, while Type (Tier) 2 operators operate similarly to microfinance banks, with limited capacity compared to Tier 1 counterparts.

Previous licensing structure

Previously, each BDC had a license issued by the CBN, which was renewed annually at a nominal fee: N5k for Level 1 and N1k for Level 2. To start a BDC required initial registration with the CBN, with a capital requirement of N2 million for Tier 1 and N500k for Tier 2. This capital represents the amount of start-up capital required in the operator’s account.

New mining strategy

Instead of the usual license renewal process, the CBN is terminating all existing licenses and requiring new registrations. In a move that many see as extremely exploitative, the capital required for registration was quietly increased from N2 million to N2 billion for Tier 1 and from N500k to N5 million for Tier 2.

But the exploitation doesn’t stop there. Previously, Tier 1 operators paid a non-refundable license fee of N5k and a non-refundable registration fee of N1k, totaling N6k. Tier 2 operators paid a license fee of N2k and a non-refundable registration fee of N250, totaling N2,250. These fees are still listed in the CBN guidelines available on their website.

With the new application process, fees have skyrocketed. Tier 1 operators currently face a non-refundable registration fee of N1 million and a non-refundable license fee of N5 million, totaling N6 million. Tier 2 operators are now required to pay a non-refundable registration fee of N250k and a non-refundable license fee of N2 million, totaling N2.25 million, as stated in the recent circular.

Meaning

With these exorbitant increases, the CBN sends a clear message: either close your operations or endure financial exploitation. This raises the question of whether the CBN is actually trying to regulate the sector or is it merely taking advantage of BDC operators.

Furthermore, the move appears contradictory, given the CBN’s ongoing efforts to stabilize the Naira. The exploitation of BDC, a key part of the currency exchange ecosystem, could further destabilize the Naira, exacerbating the problem that the CBN claims to solve.

Bureaucratic nightmare

Adding to the frustration is the anticipated bureaucratic nightmare. Under the current CBN structure, obtaining a license will likely involve navigating a maze of bureaucracy, favoritism and relationships, making the process a difficult one for those with appropriate political or financial power.

Conclusion

In short, the CBN’s new strategy is both cunning and exploitative, causing undue financial strain on BDC operators. The move threatens the livelihoods of these operators and risks further destabilizing the Nigerian currency.

It remains to be seen how this policy will play out, but the immediate reaction from the BDC community was one of apprehension and distrust.