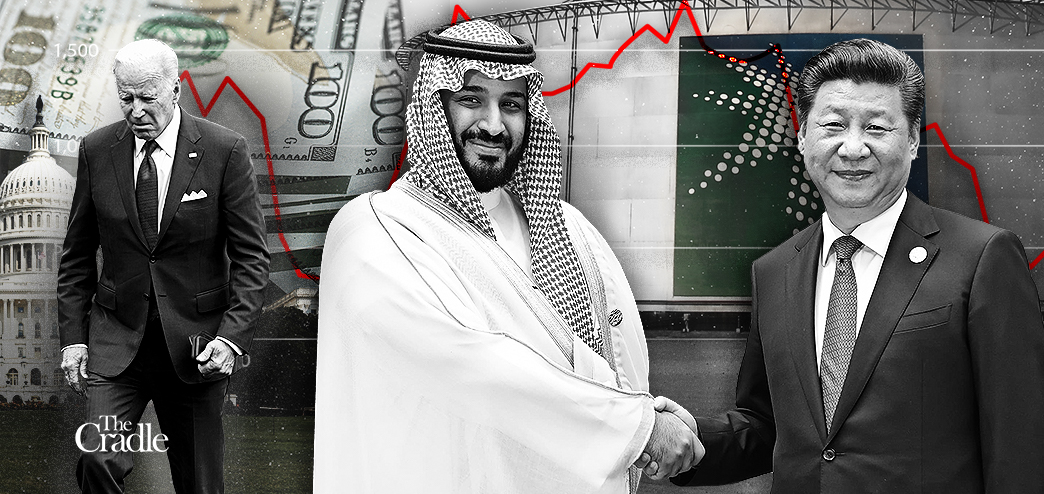

In a seismic shift that rippled through global markets, Saudi Arabia announced the end of its 50-year-old Petrodollar agreement with the United States. The historic move signals the end of an era when the US dollar dominated oil trade and hints at a new world order in which multiple currencies, including the Chinese yuan, the euro, the yen and the renminbi, will play a major role.

The Petrodollar system, established in 1974, was a pact between the United States and Saudi Arabia, the world’s largest oil exporter at the time. Under the agreement, Saudi Arabia agreed to price its oil exports entirely in U.S. dollars, ensuring steady demand for the greenback. In return, the United States provided military and economic support to the oil-rich kingdom.

Fast forward to 2024, and the landscape has changed dramatically. The rise of China as a global economic power, coupled with the growing influence of the BRICS nations, has shifted momentum away from the dollar. Saudi Arabia’s decision to abandon the Petrodollar is a clear sign of this shift.

The end of the petrodollar has far-reaching implications. For the United States, it means a loss of influence in the Middle East and a blow to the dollar’s dominance as the world’s reserve currency. For the rest of the world, it opens up new opportunities for trade and investment, as countries can now choose which currency to use when buying oil.

As the dust settles on this historic announcement, one thing is clear: the world is changing, and the collapse of the Petrodollar is just the beginning. The rise of new powers, the emergence of digital currencies, and the growing importance of environmental sustainability are all shaping the future of global trade.

The end of the Petrodollar is a wake-up call for the United States and a reminder that no empire lasts forever. As we enter this new era, it will be important to adapt, innovate, and focus on building a better future.

The US dollar may need to find a new role. It may venture into cryptocurrencies or become the official currency of the United States under Amazon. Either way, the greenback faces a challenging transition. But it can be comforting to know that it is not alone – the British pound, the French franc and the Dutch guilder have all undergone similar changes.