- Jason Isbell honors R.E.M. in the Songwriters Hall of Fame

- Stevie Nicks cancels concert at last minute due to ‘Illness;’ Fans are outraged

- Jonathan Majors and Meagan Good’s relationship journey

- Former Spandau ballet singer Ross William Wild allegedly recorded himself assaulting sleeping women, court hears

- Park Min-young: Accepted plastic surgery and became a star

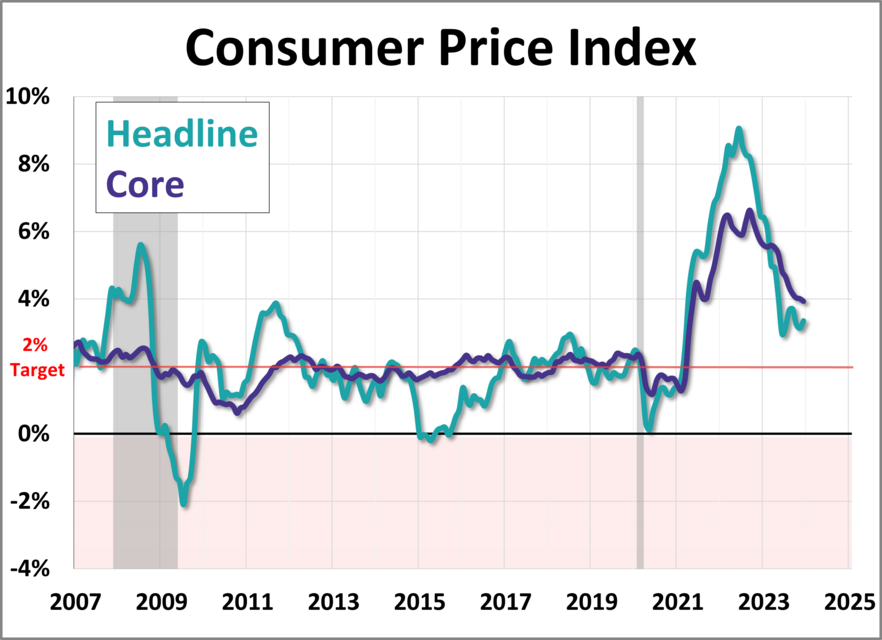

The US consumer price index for last month was announced, showing an increase of 3.3% compared to the same month last year. This is the second consecutive month that the increase rate fell below the previous month’s level, partly easing concerns about inflation.

You are watching: US May CPI data released: Consumer price index increased 3.3% in May vs. 3.4% expected

Data from the Department of Labor shows that when compared month-to-month, in May prices remained stable around April, compared with a 0.3% increase registered in April compared to March.

Also read:

US Fed policy: 5 key factors influencing the decision

The report was better than expected by analysts, who forecast monthly inflation of 0.1% and price growth of 3.4% year-over-year, according to a consensus compiled by Market Watch .

Energy prices are down, especially gasoline. But real estate and restaurant prices continue to rise.

Core inflation, which excludes the most volatile food and energy data, also performed better than expected, standing at 0.2% in the monthly measurement compared with 0.3% in April vs. March and more importantly remained at 3.4% over 12 months. month in May compared with 3.7% year-on-year in April. Results were also better than market expectations, with expected readings of 0.3% and 3.5% respectively .

Fed officials are checking inflation from month to month, trying to gauge their progress in fighting rising prices. Even as inflation is generally easing, basic goods like food, rent and health care remain much more expensive than they were three years ago, a continuing source of public discontent and a source of concern. potential threat to President Joe Biden’s re-election efforts. Most other indicators show the economy is in good shape: Unemployment is low, hiring is strong and consumers are traveling, visiting restaurants and going to shows.

Inflation changed to a downward trend in April, the first time since January. Rubeela Farooqi, chief economist at High Frequency Economics, summarized: “Price pressures remained elevated but showed a welcome moderation last month”. The New York Stock Exchange reacted positively to the inflation data and opened sharply higher this Wednesday. The Dow Jones index increased 0.92% in the first trading session of the day. The Nasdaq and S&P 500 technology indexes, which hit records on Tuesday, rose 0.89% and 0.86%, respectively. President Joe Biden, who is seeking re-election, welcomed in a statement: “Prices remain too high, but the report released today shows encouraging progress in reducing inflation.”

See more : List of leading nuclear and space research centers in India

During the campaign, Biden accused Republicans of having a “different approach” to the economy that included “tax cuts for the rich and big companies.”

Expectations for the Fed

These figures will comfort the Federal Reserve (Fed, central bank), which will end its June monetary policy meeting at noon this Wednesday, Washington DC time. Federal Reserve Chairman Jerome Powell at a press conference on May 1 in Washington. In all cases, the data were above the Fed’s 2% annual inflation target. The market expects this agency to keep interest rates unchanged at 5.25%-5.50%, the highest level in more than 20 years. Central banks raise interest rates to fight inflation: by raising interest rates, credit becomes more expensive and that discourages consumption and investment, cooling the economy and limiting pressure on prices . The market is waiting for clues about the final interest rate cut this year.

The PCE inflation index, the index most closely followed by the Fed, remained steady in its 12-month measure in April, at 2.7%. May data will be known at the end of June.

Full details on inflation

In May 2024, U.S. consumer prices were flat, a stabilization that followed a 0.3% increase in April and reflected diverse industry trends.

Krye drivers include a 3.6% drop in gas prices and a 0.4% increase in housing prices. This is the fourth consecutive month this increase has remained the same. If we talk about core inflation, it increased by 0.2% excluding food and energy prices. There were significant increases in the number of people seen in homes, medical care and used cars, while airfares and new vehicles fell. If we talk about the yearly basis, the all items index increased by 3.3%, slightly lower than the previous month. This consumer price correction reinforces expectations of a possible interest rate cut by the Federal Reserve.

- Inflation: Still below the Federal Reserve’s 2% target

- Core CPI: Does not include food and energy; increased by 0.1%

- Year-over-year increase: Core CPI increased 2.0% over the past 12 months

- Energy prices: Down 0.6%

- Food prices: Increase 0.3%

- Housing prices: Continue to increase but at a slower rate

- Economic growth: Showing signs of slowing down

- Labor market: Strong but showing signs of cooling down

- Federal Reserve Policy Current View: Interest rates on hold

- Market expectations: The possibility of interest rate cuts increases

- Previous action: Four rate hikes in 2018

- Fed officials: Mixed signals on the need for immediate interest rate cuts

- Investor sentiment: Optimistic about the possibility of interest rate cuts

- Bond market: US Treasury bond yields decreased

- Stock market: Positively affected by expectations of interest rate cuts

- Employment: Unemployment rate is low at 3.6%

- Manufacturing: Experiencing a slowdown

- Global trade: Tensions affect business and investment confidence

- Economists: Divided on the need and timing of interest rate cuts

- Market Analysts: Predict at least one rate cut by year-end

- Trade tensions: Ongoing issues with China affect the economic outlook

- Global growth: Concerns about slowing growth in major economies

Source: https://anhngunewlight.edu.vn

Category: Blog